How Finance works ?

What is Finance?

The finance department is the vitality of every economy as well as any business or personal venture. It’s the field that deals in the administration, development and analysis of investment, financial as well as other financial instruments. The field of finance is broadly classified into three major types: personal finance, corporate finance as well as the public sector. Each has a crucial part in the shaping of economies and society.

Types of Finance

1. Personal Finance

Personal financial planning is the management of your family’s or an individual’s financial decision-making, such as savings, budgeting, investment in retirement, planning for retirement, as well as insurance. Important elements of personal finances include:

Income Management Payroll, salary bonuses, salary, and additional sources of income.

Budgeting:

Planning how to divide income between expenditures, savings and the investment.

Saving and Investing The process of building wealth is by investing in saving accounts, stock bonds or mutual funds.

Retirement planning:

Preparing for financial safety after active life.

The term “insurance” refers to protecting oneself as well as your family members from unavoidable dangers.

Good financial management for personal finances will ensure that people meet their financial goals, and also protect their financial future.

2. Corporate Finance

Corporate finance covers how companies manage their financial operations and their capital structure. It requires the strategies used that focus on getting money, managing investments and the allocation of funds so that shareholders get the most value. The most important aspects are:

Capital Investment Decisions Identifying the projects that businesses should put their money into.

Financing Options:

Read more : CPM Garage Mod apk Unlimited Money and Gold

Deciding the best sources of finance – equity or debt.

Dividend The decision:

How much profit will be divided among shareholders.

Working Capital Management: managing the liquid assets and short-term liabilities.

The efficient management of corporate finances is crucial to ensuring steady growth of the business and profit.

3. Public Finance

The concept of public finance is a focus on the function of the government in economic. It is the process of collecting revenues (mainly by way of taxes) and the disbursement of spending to different industries. The most important fields comprise:

Taxation Policy:

Methods and principles to collect taxes.

Government expenditures: Spending on public products and services, such as healthcare, education, and infrastructure.

Budget Deficits and Public Debt Controlling borrowing to finance projects of the government.

Fiscal Policy Utilizing government expenditures and tax policy to affect the direction of economic growth.

Public finance is essential to ensure the stable and long-term growth of a country.

Importance of Finance in Today’s World

Finance is essential to ensure personal security as well as business growth and the prosperity of our nation. The primary reasons behind its significance are:

Key Financial Concepts Everyone Should Know

Time Value of Money (TVM)

It is the idea that a certain amount of money has more value today than it will in the near future because of its earning potential. Knowing TVM is essential for making investment decision making.

Risk and Return

Each investment is subject to a specific amount of risk. And typically, riskier investments offer an opportunity for greater return. The balance between return and risk is crucial in managing your portfolio.

Diversification

An approach to spread investments across various assets to lower the risk. It’s an important principal of modern day investment strategies.

Liquidity

The term “liquidity” refers to the ease with which an asset is converted to cash. The assets with the highest liquidity, for example savings accounts, are able to be accessed quickly and without losing their value.

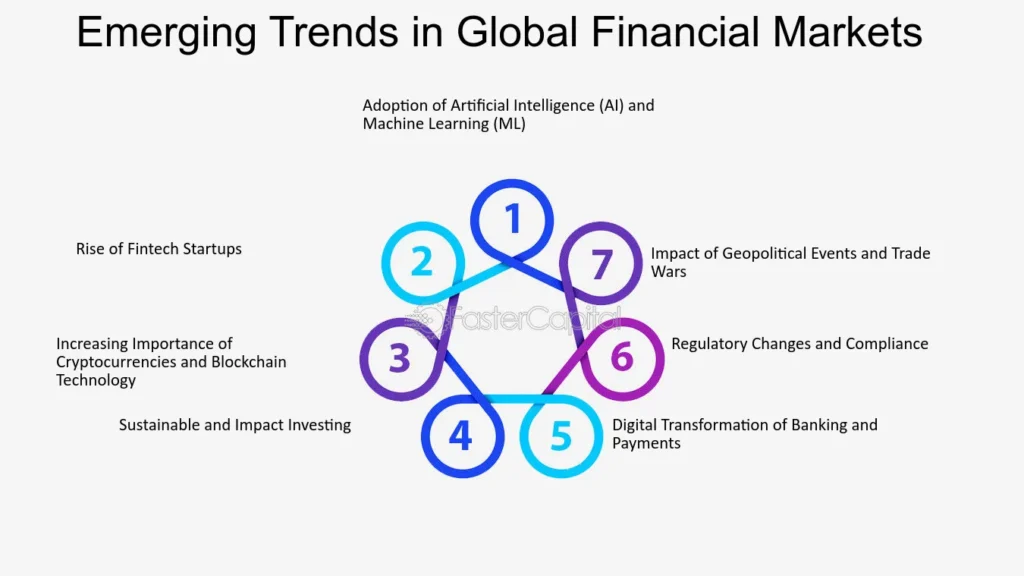

Emerging Trends in Finance

1. Fintech Revolution

The development of technology for financial services (Fintech) revolutionized the world of the world of finance, introducing the mobile banking system, cryptocurrencies as well as peer-to-peer lending and robot-advisors. Fintech has made banking services more affordable, effective and customer-centric.

2. Sustainable Finance

More and more investments are directed to sustainable and environmentally responsible firms. Sustainable finance concentrates on growth over the long term without affecting the natural environment.

3. Decentralized Finance (DeFi)

DeFi is a form of finance which eliminates intermediaries from financial transactions. The platform allows users to credit, loan and trade with no brokers or banks.

4. Artificial Intelligence in Finance

AI optimizes financial services through high-end analysis, fraud detection, risk assessment as well as customized financial advice.

Conclusion

Finance is the fundamental element of our modern lives that affects everything from individual financial wealth to economic stability across the globe. Be it managing the budgets of households as well as directing growth in corporations, as well as overseeing government expenditures an knowledge of finance is crucial. By embracing financial literacy, keeping up to date with new trends and implementing the most fundamental principles of finance can lead to long-term prosperity and sustainability.